Practice Areas

Our Practice Areas are Defined by Who We Serve:

Managed Services Providers, Professional Services Businesses, Persons with Wealth, & Real Estate Interests

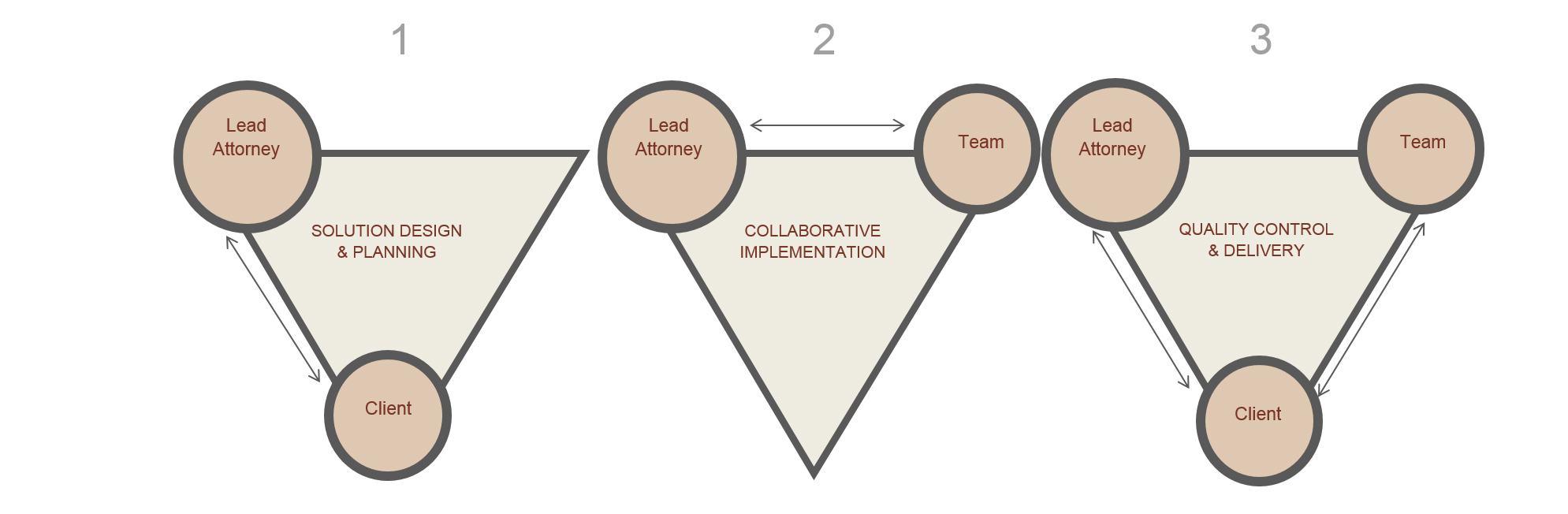

All Matters at Virtus Law are subject to a process called the Virtus Triangle:

Our Team of Attorneys

Thomas M. Fafinski

Co-Founder

Nathan W. Nelson

Co-Founder

Steven V. Rose

Attorney

Ryan D. Kaplan

Attorney

Bruce L. Beck

Of Counsel Attorney

Christopher J. Motz

Of Counsel Attorney

What Some of Our Clients Say

I want to express my appreciation for all the help I have received from Virtus Law over the last few years. Initially I was referred to Tom Fafinski by my accountant regarding a tax issue. Tom went well beyond my expectations, talking me through my options during multiple phone conversations. I was very impressed with the caring, thoroughness and professionalism he showed me. I am working with Ryan at the firm now and I’m again very impressed with his knowledge and attention to our needs. In my experience, the quality service Virtus provides its clients is a common thread that runs throughout the firm, from the attorneys to the office staff. I am grateful to have found a legal partner that I can trust to work in my best interest. I don’t need a law firm often but when I do I use Virtus.John L.

Tom and his team have handled a bunch of work for our firm and it all has been a very successful deal.Mike H.

I met Tom Fafinski through the real estate group MREE (Minnesota Real Estate Exchangors) in 2009. At the time, one of the big Minneapolis law firms was representing me in a real estate work out and was getting no where. I hired Tom and his partner Nathan Nelson and through some deft negotiations between them and the lender we were able to save the building for our portfolio. They also, in conjunction with our CPA, worked out the resulting tax problems very nicely. Since then, Virtus Law has represented me in a number of matters, all of which have come to, or I believe will come to, successful conclusions.Mark Z.

Don’t Hesitate To Ask

Schedule A Consultation

Fill out the form below to receive an initial consultation. Don’t worry, we never

share your information or use it to spam you.